Table of Contents

Fees

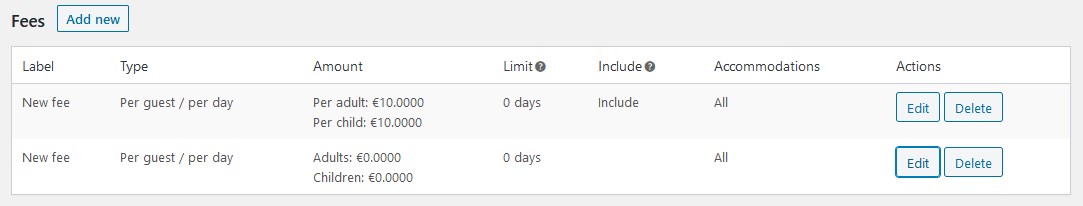

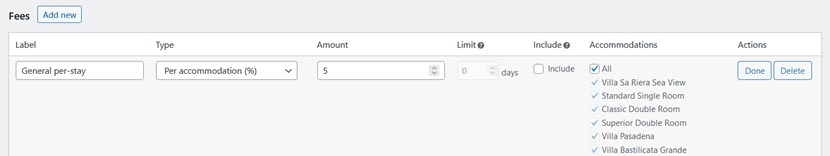

Fee is a separate mandatory charge in addition to base accommodation rate. Follow the steps below to add a new fee:

- Go to Bookings>Taxes & Fees> push Add New button (next to Fees)

- Give a name to your fee e.g. ‘Cleaning fee’. This label will be shown at Checkout page under price breakdown.

- Select whether to charge the fee per guest or per accommodation:

- ‘Per guest / per day’

- ‘Per accommodation / per day’

- ‘Percentage’ (applies only to property cost, excluding services).

3. Define the price (Amount) of fee for Adult and Child. (when you set to ‘charge per accommodation’, there is single box for price).

4. Next you can set a limit of days the fee is charged. If you put ‘0’ days the fee is charged each day of stay period. If you want to charge once only, set 1 day.

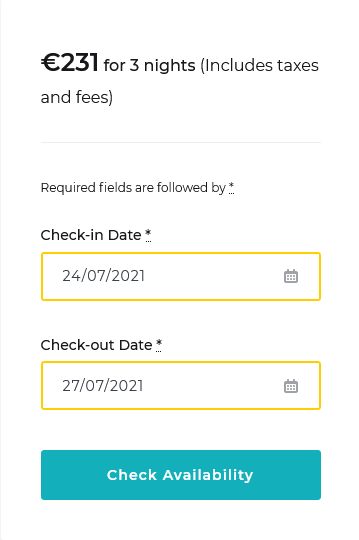

5. Tick “Include” if you want to show the accommodation price with this fee included (it’ll be multiplied by dates if arrival and departure dates are specified).

6. Check the accommodation types you want to tie the fee with. You should uncheck All to select certain accommodation types.

7. Click ‘Done’ and ‘Save Changes’

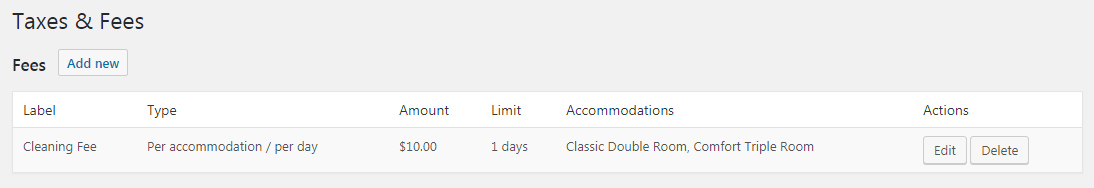

Here is an example of Cleaning Fee with price $10 and that is charged once (1 day limit) for whole accommodation (not per guest) and is tied to Classic Double Room and Comfort Triple Room

You can add unlimited amount of fees in the same way.

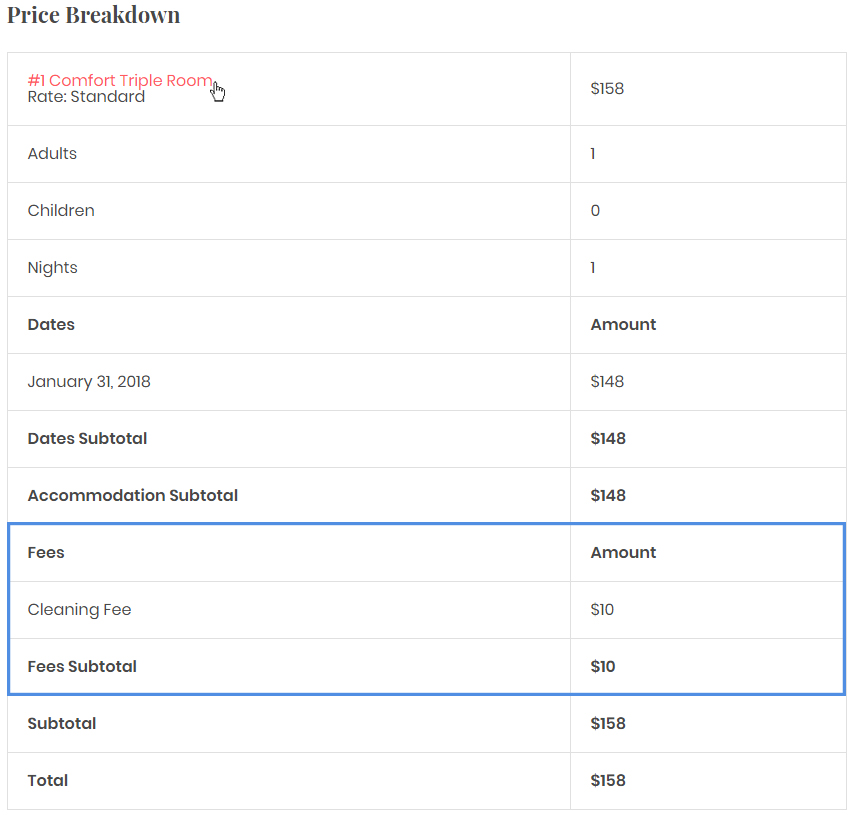

Your guests can see all applied Fees at checkout page by breaking down the price table

Taxes

You can add Taxes for Accommodations, Services and Fees separately.

Taxes for Accommodations

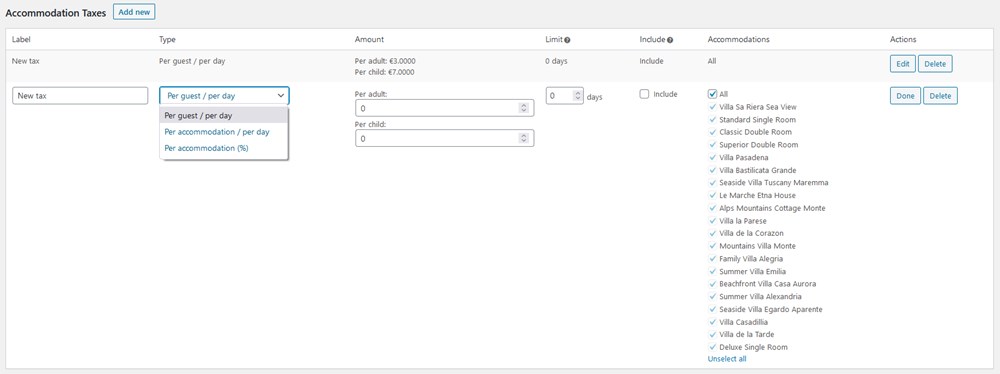

In order to make Accommodation types taxable you should navigate to your Dashboard → Bookings → Taxes & Fees and follow the next steps:

- Click Add new button next to Accommodation Taxes

- Name the Tax. The label will appear in a price breakdown on the frontend (your guests will see it).

- Select a type of the tax among:

- Per guest / Per day – allows to add different tax for adult and child.

- Per accommodation / Per day – add fixed tax for accommodation per day – not depending on guests quantity.

- Per accommodation in percents (%) – add tax in percents for accommodation without days count.

4. Define ‘Amount’ of Tax – this will depend on type of the Tax – percentage or price.

5. Add limit of days if needed. When there is ‘0’ the tax will be applied to all days of stay-in period. You can put ‘1’ to charge the tax once only.

6. Select “Include” if you want to display a property rate on the site with this accommodation tax included.

7. Check the accommodation types you want to apply this tax for. You should uncheck All to select certain accommodation types.

8. Click ‘Done’ and ‘Save Changes’

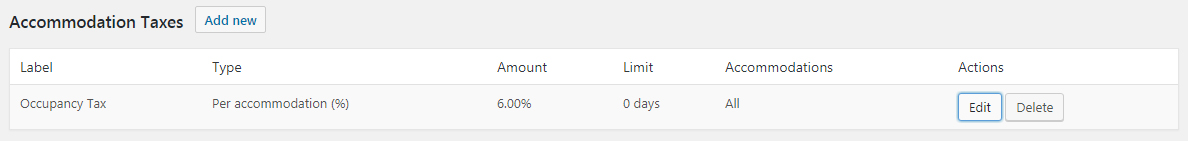

Here is an example of 6 % Occupancy Tax for whole accommodation and is applied for all Accommodation Types

You can add more Taxes in the same way.

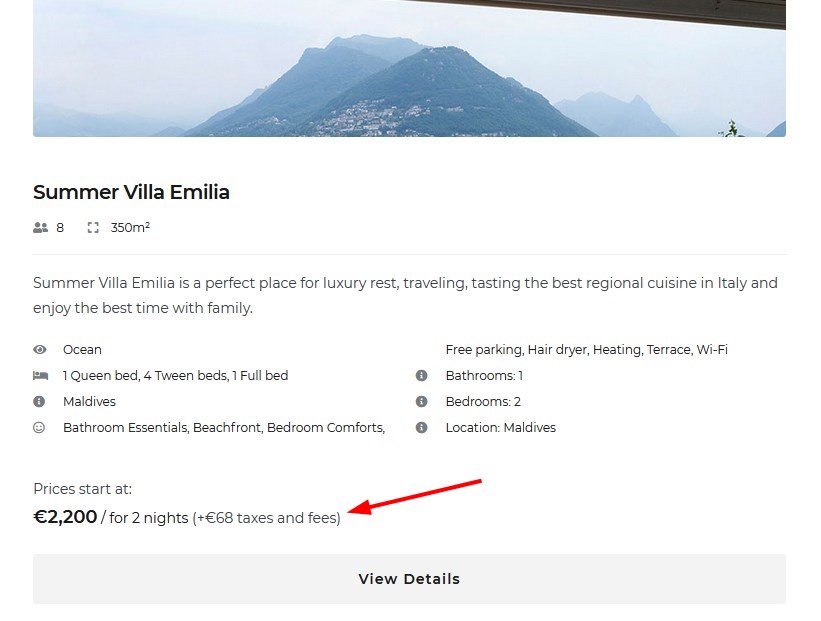

Your guests will see all applied taxes at checkout page by breaking down the price table.

How to include or exclude accommodation tax and fee charges into the property rate

- “Include” ticked – tax and fee charges included

- “Include” not ticked – tax and fee charges displayed separately

Watch a video explanation

Watch a video explanation

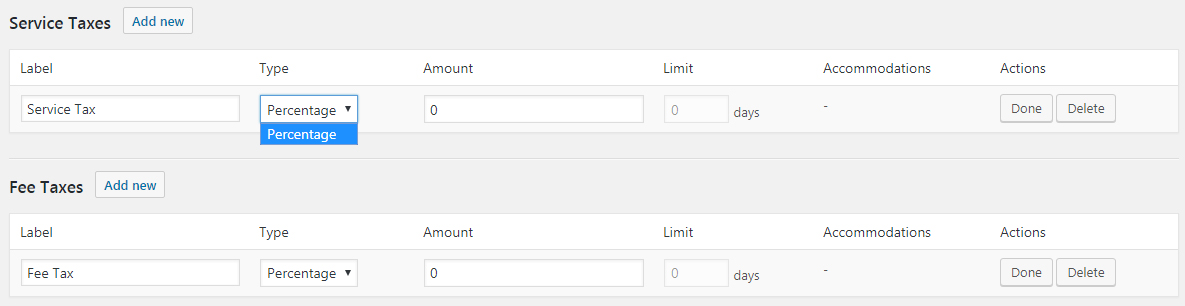

Taxes for Services and Fees

In addition to Accommodation taxes, you can also add taxes for Services and Fees separately. There are the same properties for both types of taxes available:

These percentage taxes are for total fees and services amount.

Tip: If you need to apply Tax for total sum of reservation, you should create a tax for each type (accommodation, service (if there are any) and fee(if there are any)) with the same percent amount.

Your guests will see all applied taxes at checkout page by breaking down the price table (before they pay).