MotoPress Hotel Booking Plugin for WordPress News: Manage Taxes and Fees

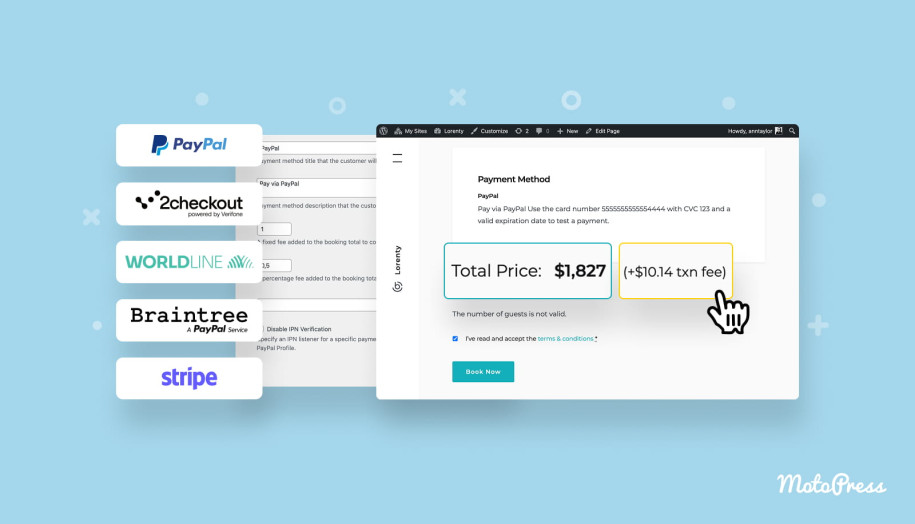

Taxes and fees imposed on your hotel establishment should be properly recorded and shared with customers. Using the 2.4.0 version of the MotoPress hotel booking plugin for WordPress, you’ll be able to include the taxes and fees info into the summary of accommodation charges. This will ensure legal compliance making your guests aware of all the charges! To start configuring your pricing information, go to Bookings > Taxes and Fees.

UPDATE: Since version 3.9.8, our Hotel Booking plugin is able to display Taxes & Fees directly in the Property rate. Now guests will be able to see the final price with taxes & fees included right in the accommodation search.

Watch this video:

Now, this is how you can add all types of taxes and fees you must include into the accommodation charge:

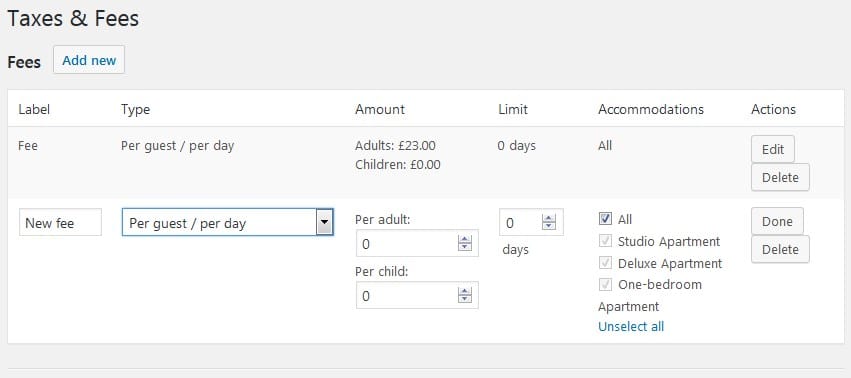

Fees

- Add all needed fee labels that will be displayed to guests on the checkout page (e.g. resort fee, service fee).

- Select a fee type – per guest/per day or per accommodation/per day.

- Set the charge per adult and per child if needed.

- Set for how long the fee should be applied: set a number of days or don’t set a limit at all.

- Select a specific accommodation the fee should be applied to (or set it to All).

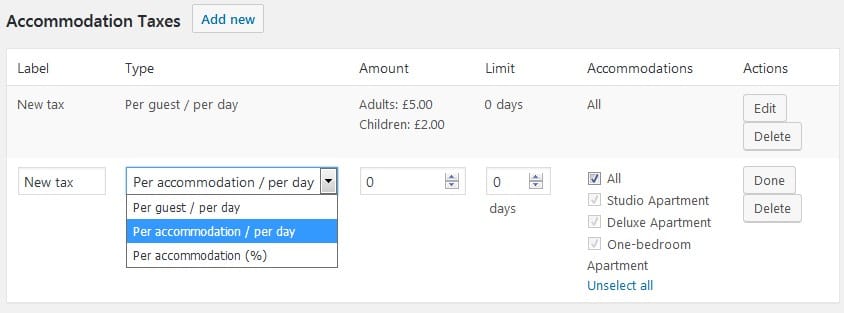

Accommodation Taxes

- Add all needed tax labels – they will be also displayed to guests on the checkout page (e.g. occupancy tax, city tax).

- There are 3 types of accommodation taxes you may set: per guest/per day, per accommodation/per day, and per accommodation (%).

- Set the charge per adult and per child.

- Set for how long the tax should be applied: set a number of days, 1 day for a one-time charge, or don’t set a limit at all.

- Select a specific accommodation the tax should be applied to (or set it to All).

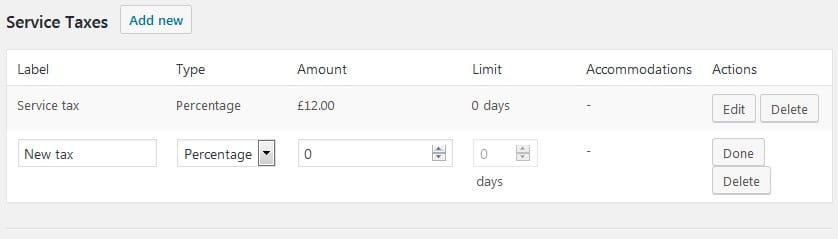

Service Taxes

So far, you may set the service taxes for all accommodations.

- Add the labels for all service taxes – remember that they are visible to guests on the checkout page (e.g. service tax).

- The only one currently available type is percentage.

- Set the amount of a service tax (e.g. 10%)

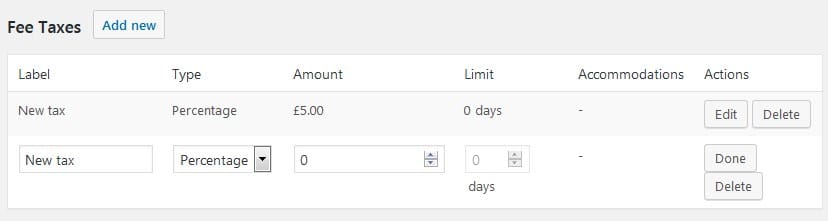

Fee Taxes

If it’s needed to include specific fee taxes (taxes on fees) in your hotel establishment, you can do it with the Fee Taxes menu.

- Add the labels for all fee taxes – remember that they are visible to guests on the checkout page.

- The only currently available type is a percentage.

- Set the amount of a service tax (e.g. 10%).

Direct website bookings or OTA? Data might hint you at the answer.

On the frontend

The accommodation prices displayed on the site listing don’t include taxes and fees charges, just the basic rates are shown.

The travelers will see all the pricing info in the final Summary of Charges table (before completing a purchase). It’s collapsed by default:

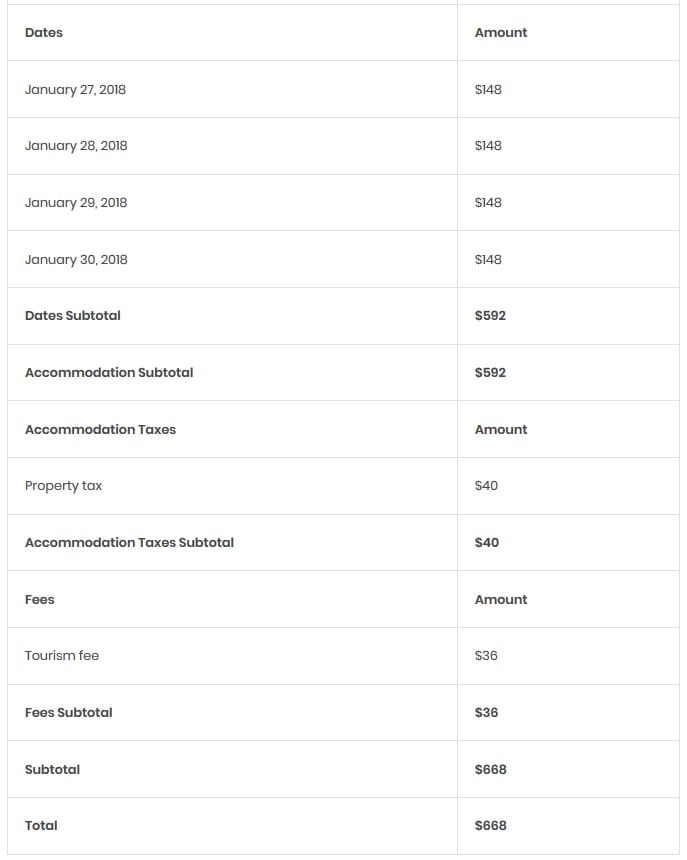

But they can expand it to see the details, including all taxes and fees:

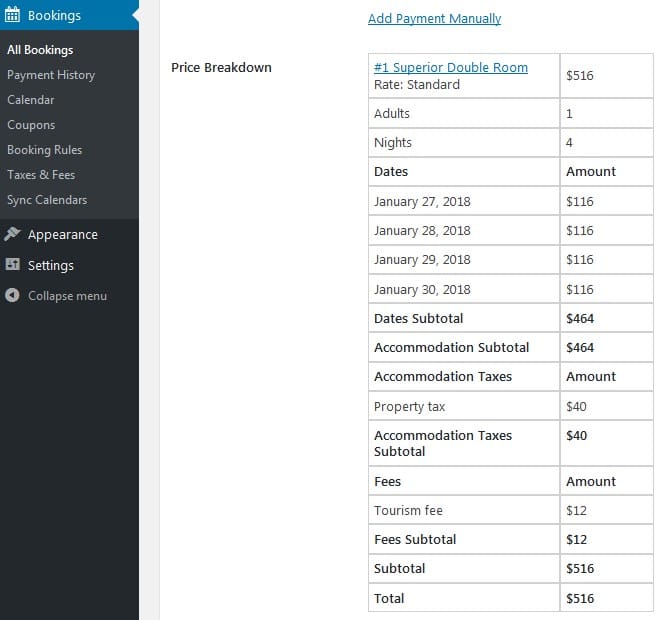

Once the customer completes the purchase, you can see the pricing info with all taxes and fees details in the admin dashboard. For example (a random booking)

As you see, it’s extremely easy to set up the system and record your hotel/vacation rental charges in the right way. Test a new version of the WordPress booking system for hotels and don’t forget to send your questions and suggestions!

I need to charge a refundable breakage deposit, but it is per stay (not a percentage, per guest or per night). How do I go about this? Is this a way to change the type?

Thanks

Hi, Taylar!

Unfortunately, there is no “Per stay” fee type, however, you may simply set the “Limit” option to 1 day, so the fee is charged once per the whole stay: https://prnt.sc/rlz5hp -> https://prnt.sc/rlz5q7 . You will be able to refund this fee to your guest credit card afterwards.

For a site I’m developing, an agency takes a percentage per booking for each letting property they manage. Is it possible to use the Taxes and Fees for calculating the percentage (based on a set rate) per each property but hide this from customers booking the property?

Hi Mark,

Even of you hide a tax or mandatory fee your customers might have questions looking at price breakdown. So we’d recommend to form rates including the commission percentage.