Compare WooCommerce Payment Gateways for Small Business on WordPress

Table of Contents

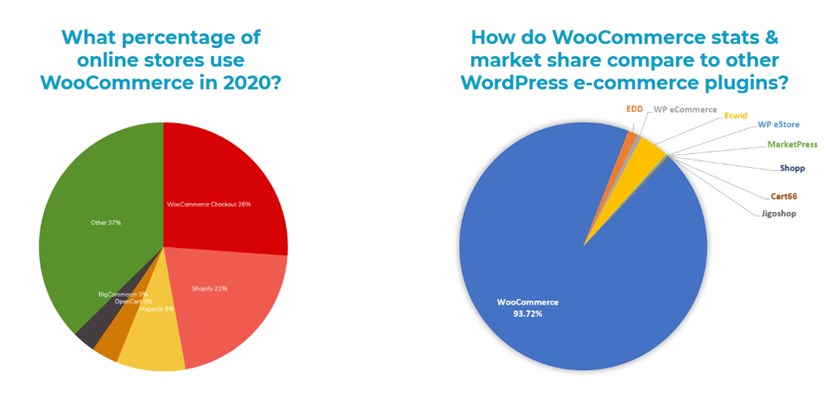

There is no denying it – WooCommerce payment gateways are the most chosen solutions for the vast majority of e-commerce, both cross-border and local, businesses on WordPress.

When you need to integrate online payments on your small business website, most likely you’ll join WooCommerce as well (for many good reasons!).

According to the recent WooCommers stats 2020, WooCommerce powers more than 93% of all e-commerce websites on WordPress compared to other dedicated solutions.

That means there is a huge ecosystem of powerful businesses creating solutions sharpened for WooCommerce users.

Going with a very rough categorization, this post might help you with details if you are in one of the following scenarios:

- You run a WooCommerce-powered store selling products or services and just need to understand which payment gateways are the best to connect and start accepting payments.

- You run a small business website on WordPress that is connected to another dedicated WordPress plugin or a bunch of them. And these third-party plugins also integrate easily with WooCommerce (appointments, membership, etc.).

In either case, your first factor to consider is your home country: there are international and region-specific payment gateways that either work or don’t in your region or in the countries you want to accept payments from.

You also must think about your customers first – who are they and what payment gateway they’d prefer. This takes us to the second part.

WooCommerce setup for beginners – video tutorial

Currencies and Countries

If you need your online store on WordPress WooCommerce to be friendly to international shoppers, there is some lingo to understand and check with the payment gateways you are considering:

- Presentment currency (from the word “present”) is the currency of goods and services displayed on your website, thus, the currency in which customers pay you. It’s usually your local currency. The prices can be presented in several currencies to meet the needs of international shoppers.

- Settlement currency is the currency of funds you’ll get into your account.

To increase the likelihood of conversion, multi-currency and local payment gateways are required.

If the presentment currency differs from the customer’s card currency, customers most likely will be charged conversion fees before funds can appear in your business account in your domestic currency. So make sure to check out the currency account setup and currency exchange fees for the payment gateway you find suitable.

SSL Certificate

It’s crucial to understand that all of the WooCommerce payment options we are about to list will work only for shops that have an SSL certificate in place. It’s highly important for secure personal and billing data transmission through your website.

If you’re with MotoPress and want to skip the manual work of setting it up (or if your hosting doesn’t provide it), feel free to order the dedicated SSL certificate service and have it set up by experts.

WooCommerce Payment Gateways for Small Business

Remember that bank transfers, cheques, and cash on delivery (COD) are available as default payment methods and are free to use with WooCommerce. As for more complex payment gateways, let’s talk about them.

In this article, we’re comparing a few best WooCommerce payment gateways: PayPal, Stripe, Authorize.Net, and Amazon Pay.

These addons are just middlemen between your WooCommerce store and the official payment platform provider. Consequently, it’s quite possible that a WooCommerce addon might not support/ support with delays some features offered by the original gateway.

Check out all WooCommerce payment gateways for more detail for specific local gateways.

There are numerous details so we’ll start with the general description and will provide more details to visualize crucial data in the comparison table right after the descriptions.

PayPal for WooCommerce

There are a few WooCommerce extensions that can help you integrate PayPal, free and premium:

- PayPal Standard

- PayPal Advanced

- PayPal Checkout

- PayPal Here

- PayPal Powered By Braintree (we chose this one for comparison)

- PayPal Pro

- PayPal Pro Hosted

They require a comparison table of their own, so make sure to choose the one you need (check out this PayPal Extensions Comparison for WooCommerce).

As far as I am aware, PayPal Standard and PayPal by Braintree (a division of PayPal) are the most popular extensions with customers since they work in multiple countries (therefore with multiple currencies), are also compatible with WooCommerce Subscriptions and don’t charge monthly PayPal fees.

Moreover, PayPal by Braintree is the only way to accept both cards and PayPal through a single integration. It allows you to accept payments from 45 countries; the payment methods include ACH Direct Debit, Apple Pay, Google Pay, Samsung Pay, plus such local gateways as UnionPay, Venmo, and Visa checkout. How did PayPal exist before this invention?

Authorize.Net for WooCommerce

Although it might be one of the most expensive options in this list, Authorize.Net is very popular with WooCommerce users since it has a very broad worldwide reach and offers such awesome tools as customer profiles, card tokenization, and eCheck.

Since this is an integrated mobile-friendly gateway, you’ll provide an awesome checkout experience for your shoppers – the latter will be able to complete the payment on your website from A to Z.

As one of the most used gateways, Authorize.net accepts payments with all major credit and debit cards (Visa, MasterCard, American Express, Discover, Diner’s Club, JCB).

Accept.js support offered through the plugin means credit card information is processed by Authorize.Net and not by your server to make the payment process more secure (PCI SAQ A-EP compliance).

The extension seamlessly works with recurring payments through the WooCommerce Subscriptions and also supports full or partial refunds. To allow shoppers to store their payment information, you need to use the Customer Information Manager (CIM) by Authorize.Net.

Stripe for WooCommerce

Stripe is an integrated payment gateway (handles payment on your website without redirection) that accepts payments in over 135 currencies from 36 countries. Since it supports multi-currency, it can convert currencies based on your user’s selection.

In addition to major cards, it supports digital wallets (Google Pay, Apple Pay) and local payments through Alipay, iDeal, or SEPA Direct Debit. Recurring payments and refunds are supported through this extension.

To improve the checkout process for shoppers, you can benefit from Stripe Elements, which helps your users provide their payment information at checkout much quicker and easier.

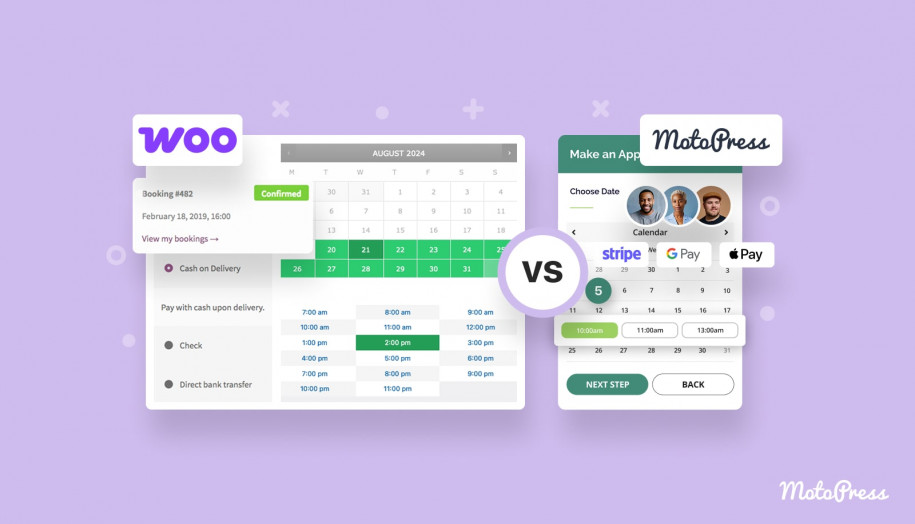

MotoPress is the official Stripe partner (that technically means Stripe verified that Stripe payments through the Hotel Booking plugin are handled securely). The appointment scheduling WordPress plugin also fully supports Stripe payments.

Amazon Pay for WooCommerce

Amazon Pay is one of the most popular payment gateways with WooCommerce users since there is a huge user base of Amazon sellers and shoppers.

It includes all the traditional payment methods so you can have real chances to retain customers and decrease cart abandonment. Opting for Amazon Pay, you offer shopper familiar checkout experiences to your customers – they will be able to pay through their Amazon accounts without a need to register since they can use their prepopulated details.

The add-on is super easy in setup and operation so most likely you’ll be able to run it within hours. The payment gateway also supports multi-currency. Refunds, recurring payments, and other business-critical tools are fully supported.

To start using this add-on on your WooCommerce-based website, you must have an Amazon Payments Advanced Merchant account.

WooCommerce Payment Gateways Comparison Table

The information and prices are correct as of March 2020

| Stripe | PayPal (by Braintree) | Authorize.Net | Amazon Pay | |

| Countries | 36+ countries: United States, Canada, United Kingdom, Europe, Australia, India, Japan, Hong Kong, Malaysia, New Zealand, Singapore | 46 counties: United States, Canada, United Kingdom, Europe, Australia, Hong Kong, Malaysia, New Zealand, Singapore | United States, Canada, United Kingdom, Europe, Australia | United States, UK, Germany, France, Italy, Ireland, Spain, Luxembourg, Austria, Belgium, Cyprus, Netherlands, Sweden, Portugal, Hungary, Denmark, Japan |

| Cost of the extension for WooCommerce (1 site/per year) | Free | Free | $79 | Free |

| Signup fee | No | No | No | No |

| Commissions | No monthly fees Per transaction: 2.9% + 30¢ +1% for international cards ACH direct debit: 0.8% · $5 cap SEPA Direct Debit 2.9% + 30¢ | No monthly fees Per transaction: 2.9% + $.30 per card or digital wallet transaction $15 for each chargeback incident | Monthly gateway charge: $25 Per transaction + merchant account 2.9% + 30¢ | No monthly fees Per transaction: 2.9% + $0.30 More possible charges |

| Payment methods | Major gateways including Apple Pay, Google Pay, Alipay, iDeal or SEPA Direct Debit | Major gateways including ACH Direct Debit, Apple Pay, Google Pay, Samsung Pay, plus such local gateways as UnionPay, Venmo and Visa checkout digital wallet | Visa, MasterCard, Discover, American Express, JCB, PayPal, Visa SRC, Apple Pay, Chase Pay, eCheck | Visa, Mastercard, Discover, American Express, Diners Club, and JCB. |

| Supported Currencies | Over 135 currencies, based on a country (select your country and read details) | 130 local currencies in 44 countries | Based on a country USD, CAD, CHF, DKK, EUR, GBP, NOK, PLN, SEK, AUD, NZD | AUD, GBP, DKK, EUR, HKD, JPY, NZD, NOK, ZAR, SEK, CHF, USD |

| Security standards | PCI Level 1 Service Provider SCA Stripe Radar (extra cost) | PCI DSS v3.0 SAQ-A compliance | PCI SAQ A-EP compliance standards | WooCommerce 1.10.1 or higher, the plugin is already PSD2 compliant |

| Compatibility with WooCommerce dedicated tools | WooCommerce Subscriptions | WooCommerce Subscriptions | WooCommerce Subscriptions, WooCommerce Pre-Orders, and Accept.js | WooCommerce Subscription for some countries |

If you are in the rental property business

Here at MotoPress, we closely worked with WooCommerce gateways when developing a dedicated WooCommerce Payments extension for the Hotel Booking plugin.

So if you are already building your website with the MotoPress Hotel Booking plugin (or just plan to start your small business in the hospitality field) and need to integrate these or other extensions available for WooCommerce, this plugin will do the job.

Its main purpose is to minimize the efforts of the Hotel Booking + WooCommerce integration process to just clicking buttons and selecting the needed gateways.

Otherwise, you would need to hire an expert to code WooCommerce payment processing integration from scratch. Basically, this integration add-on gives you access to WooCommerce functionalities on your hotel or vacation rental website created with the MotoPress Hotel Booking plugin.

Conclusion: The Best Payment Gateway for WooCommerce (for Small Business on WordPress)?

Lots of small businesses can benefit from seamless WooCommerce gateways integration on their online stores. There are, of course, some country-specific limitations, multi-currency setup details, commissions, and fees you should be aware of before choosing the needed WooCommerce extension.

Choosing the best WooCommerce payment methods depends on what features are dominant for your profit-focused small business on WordPress. If you’ve settled on the best solution for your business, don’t hesitate to share it along with your business field to help others in their search.

We show you the pros and cons of the best Woo Commerce payment gateways . You have given a lot of thought to your business, but did you put a lot of Knowing more about payment gateway integration in WordPress is key in order to decide between them all. A comparison chart would be nice.